Tariffs, Two-Speed Consumers & the Rise of the Experience Economy

How Brands Like Nike, Coca-Cola, and Jaeger-LeCoultre Are Navigating Uncertainty Through Immersion

Things are moving fast, and while I need to stay focused on my work at Solomon Group, there’s too much happening at the intersection of consumer behavior, macroeconomics, and immersive brand strategy not to share. To balance things, starting with this edition, I’ll be switching to a biweekly cadence.

We’re in a moment of convergence:

- Tariffs and supply chain pressures are forcing brands to rethink not just cost structures, but how they stay emotionally relevant.

- Consumer spending is splitting with the top 10% still splurging, and everyone else pulling back hard.

- Meanwhile, experience is proving to be the most adaptable, resilient strategy, whether you're hedging against volatility, segmenting by income, or turning brand equity into a physical asset.

This issue includes a guest insight from Phill Agnew of The Nudge Podcast whose behavioral science take on brand homes helps explain why immersive spaces, from touring exhibitions to full-scale flagships, are becoming core brand infrastructure, not just flashy marketing moments.

The brands that are winning right now? They’re not just selling products. They’re designing memories, encoding meaning, and building real-world moats through experience.

Let’s dig in.

The Impact of Tariffs on Consumer Brands: Nike's Cautionary Tale

Let’s start macro. Tariffs. The U.S. has imposed hefty import duties on key manufacturing countries like Vietnam, China, and Indonesia, exactly where Nike makes much of its inventory. These policies shift, but the long-term pressure is clear.

Nike’s stock plunged 14% in a single day, erasing $13 billion in value.

Without supply chain or pricing adjustments, analysts estimate earnings could drop by 95%.

Price hikes kick in June 1, 2025, up to $10 for shoes over $150.

Without repricing, gross margins could fall from 43.5% to 29.7%.

Tariffs aren’t abstract, they force brands to either raise prices, hurt profits, or both. In Nike’s case, it’s a warning shot: supply chain fragility is now a consumer-facing issue.

Who’s Still Spending? The Tale of Two Consumers

We’re now operating in a split economy.

The top 10% (earning $250K+) account for 50% of all consumer spending, up from 33% in the 1990s.

The top 40% now drive 65% of total spending, according to EY-Parthenon’s updated 60-40 rule.

Synchrony (low-income focus) saw a 4% drop in Q1 2025 spending; Amex and JPMorgan saw gains.

Walmart is seeing more wealthy shoppers, while McDonald’s is losing middle- and low-income foot traffic.

The future of growth is skewed toward the top. Consumer brands that want to stay relevant (and solvent) must build for high-emotion, high-margin experiences that appeal to the upper tiers while also not neglecting the lower and middle segments to avoid losing future consumers.

Experiential Retail: Immersion That Converts

With product-based differentiation flattening out, brands are leaning into experiential retail as a way to earn attention, dwell time, and loyalty.

Some standout executions:

CAMP – A family-first experiential retailer mixing play zones with curated merchandise.

LVMH’s LV The Place – Blends fashion, art, food, and heritage in an immersive brand temple in Bangkok.

Buffalo Trace (London) – Turns a whiskey tasting into a sensorial trip to Kentucky, from London.

Gentle Monster – Eyewear retail becomes kinetic art, seasonal storytelling, and spatial transformation.

Genesis House NYC – Going beyond cars, there are pop-up immersive activations (for free) as well as, food, design and culture.

Canada Goose – Lets you test jackets in an Arctic simulation chamber.

Experiences build meaning. Done right, they create a reason to visit, share, and stay. Done poorly, they become cost centers. But increasingly, doing nothing is riskier than trying.

Testing the Waters: Touring Immersion & Pop-Ups

Not every brand has a flagship footprint. Temporary activations offer an agile alternative: Scalable, newsworthy, and emotionally powerful.

Jaeger-LeCoultre’s Stellar Odyssey – A celestial experience blending horology, music, and storytelling.

Glade’s Museum of Feelings – Emotion-mapped rooms tied to scent, color, and memory.

Tiffany & Co. – Museum-style archive shows how luxury jewelry doubles as cultural capital.

Spotify Wrapped @ Outernet – Fans broadcast their personal playlists to the public, IRL.

Immersive Hong Kong (Dubai) – Government-led exhibition blending tourism, tech, and civic pride.

Pop-ups and touring approaches allow brands to test, learn, and scale emotional resonance. It’s not just marketing, it’s temporary infrastructure to test long term brand home plays.

Coca-Cola at Disney: Co-Creation at Scale

Few brands are better at embedded immersion than Coca-Cola. Their partnership with Disney is decades long, and profoundly effective.

Coke is present in every Disney resort (except Shanghai), hitting 130 million annual visitors: More than 5x the NBA’s 2023 total.

Emotional receptiveness is high: happy guests, low brand clutter, strong memory formation.

Their Star Wars-themed orb bottles (written in Aurebesh) became $45 collectibles on eBay.

The design process took 4 years and 12 designers, a commitment to immersive authenticity.

Their Marvel AR cans (38 unique designs) launched in 50+ global markets, deepening relevance.

Coca-Cola has mastered both ends of the experiential spectrum: from deeply embedded brand integrations in existing immersive ecosystems (like Disney parks or Marvel crossovers) to building full-scale environments like the World of Coca-Cola. What sets the brand apart is its ability to treat immersive experiences not as side projects, but as core brand infrastructure. Whether through exclusive collectibles, AR-enabled cans, or multi-market touring pop-ups, Coca-Cola creates experiences that are scalable, emotionally resonant, and culturally timed. All while subtly reinforcing its iconic status in the global imagination.

Why Brand Homes Work (with Phill Agnew)

To understand the psychology behind immersive environments, Phill Agnew of The Nudge Podcast offers five key behavioral insights that explain why “brand homes” like World of Coca-Cola are so effective:

Operational Transparency – Watching how something’s made boosts trust and value. (Think chocolate factories or even Subway.)

IKEA Effect – When people participate (even a little), they feel more invested. (Build-a-Bear is the gold standard.)

Mere Exposure – Time spent equals fondness. No purchase required. That’s why Coca-Cola is still advertising.

Input Bias – Showing the process (“87 steps to the perfect pour”) increases perceived quality. The Guinness Museum does this masterfully.

Labor Illusion – Highlight one magical step (e.g., chocolate tasting), and people assume the whole process is magical.

Brand homes hit all five. They also make money (tickets, merch), hedge against tariff-induced cost volatility, and offer a family-friendly alternative to a $200/day theme park. Smart ones use dynamic pricing to segment by income, offering access and exclusivity all at once.

Brand homes are not museums, they're emotional engines that build equity and gather data, all while generating revenue.

Final Thought: Immersion Is Not a Trend. It’s a Strategic Shift

Whether you’re Nike trying to protect margins, Coca-Cola expanding cultural resonance, or a tourism board activating in Dubai, the throughline is increasingly clear: experience is no longer a marketing tactic, it’s a structural advantage.

In an age of tariffs and supply chain instability, immersive experiences offer a geopolitically neutral hedge. They’re location-anchored, storytelling-driven, and far less susceptible to sudden border policy changes or material cost spikes. When done well, they also enable brands to implement nuanced price discrimination: luxury dining rooms and limited-edition merch for the top 10%, while still offering inclusive, high-value engagements for price-sensitive families. A brand home can be both a premium touchpoint and a more affordable alternative to a $200+ theme park day.

You don’t have to start with a flagship like World of Coca-Cola, either. Brands today can dip their toes in through pop-ups, pilots, and touring activations, testing which stories resonate, gathering first-party data, and slowly scaling into permanent infrastructure. Think of these experiences not as stunts, but as living prototypes for long-term brand equity.

Experiential isn’t replacing product. It’s making product meaningful again. In a world increasingly driven by algorithmic choices and transactional noise, meaning is the moat.

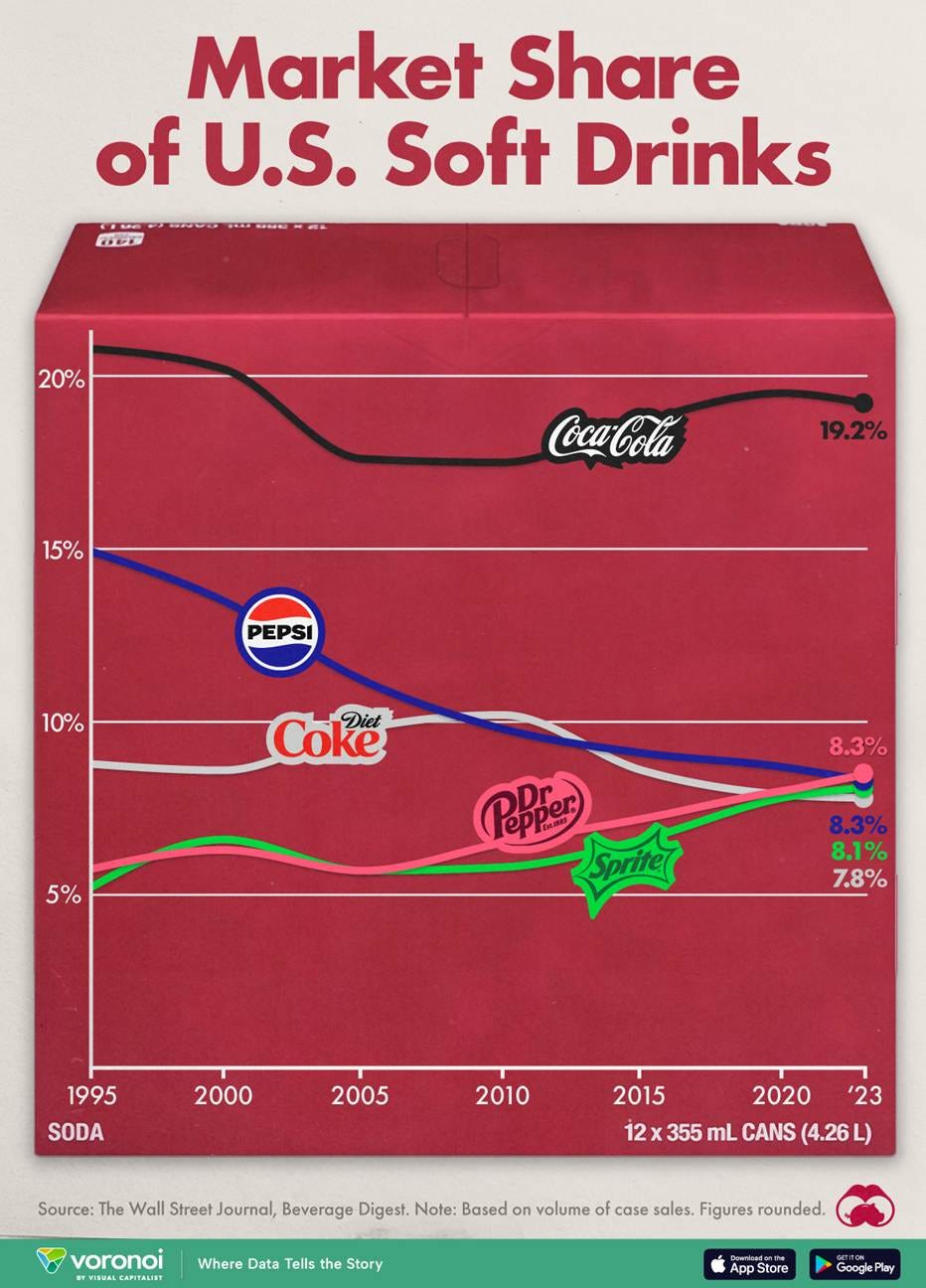

Oh and if you’re wondering, Coke’s strategy is working out – the company continues to dominate the soda market.

See you in two weeks.

– Daniel